Through all the traders I’ve had the pleasure of meeting over the years either through fintwit or discord I’ve found myself seeing the same types of people again and again. Their personalities are often a precursor to how their trading performance will be and also how they will react to their wins and losses.

Make no mistake, the person you are is the trader you are, and if you can’t go on a journey of growth as a person then you will never go on a journey of growth as a trader.

So today, we break down 4 different trading personality types, their strengths, their weaknesses and some sign-posting for each type to help them grow and focus on what they need to be mindful of moving forwards. Let’s get stuck in:

Jackpot James

James is generally impulsive and reckless in his day to day life, he came across the stock market and got lucky on the first few trades and won big. He thinks he has found the holy grail of day trading and starts bragging to all his friends about how much money he’s made. With no risk management and huge over positioning, inevitably, he loses not only all his gains but often all his money as lotto after lotto goes against him.

Jackpot James then experiences symptoms of post traumatic trading and is so discouraged that he gives up day trading altogether.

"The biggest mistake most traders make is thinking that they can control the market." - Mark Douglas, The Disciplined Trader

This book is a recommended read for those who needs to learn how to control their emotions and make more rational trading decisions.

Mark Douglas highlights the importance of controlling your emotions when day trading. The market is unpredictable, and there will be times when you lose money. It's important to stay calm and rational, and not let your emotions get the best of you.

For all you Jackpot James’ out there, here’s my biggest tips:

Accept that luck is a factor, but don't rely on it. The market is unpredictable, and there will be times when you make lucky trades. But if you want to be successful in the long run, you need to develop a trading system that works for you and stick to it.

Control your emotions. It's easy to get carried away when you're making money, but it's important to stay calm and rational when you're losing money. Don't let your emotions dictate your trading decisions.

Learn from your mistakes. Everyone makes mistakes, but it's important to learn from them and not repeat them. Keep a trading journal to track your trades and identify your strengths and weaknesses.

Stop gambling your own money and use Apex to limit your losses.

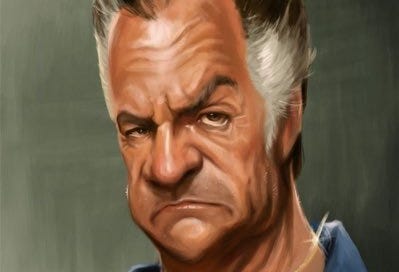

Stubborn Steve

Steve is too proud to admit when he is wrong. He keeps using the same failing methods, even though they've rarely been successful. Steve is convinced that if he just keeps at it, he will eventually figure it out. But the truth is, he’s just wasting his time and money. He’s too stubborn to admit that he needs to change his approach. Steve will hold on to losing trades, add to losing positions rather than reduce them and fail to scrap his idea until it’s often too late.

Trading in the Zone by Mark Douglas: This book is for the Stubborn Steves who needs to learn how to be more flexible and adaptable in their trading.

"The market is a master teacher, but few students are willing to pay the price of tuition." - Mark Douglas, Trading in the Zone

Mark Douglas emphasizes the importance of being willing to learn from your mistakes. The market is a constantly evolving environment, and what worked in the past may not work in the future. It's important to be flexible and adaptable, and to be willing to change your trading methods if necessary.

If these behaviours ring true for you, then here’s my top three tips to get you back on track:

Be willing to change your approach. If you're not getting results, it's time to change something. Don't be afraid to experiment with different trading strategies and tools.

Be open to feedback. Ask for help from more experienced traders or read trading books and articles. There is always more to learn, and no one is perfect.

Don't give up. Day trading is a challenging but rewarding endeavor. If you're willing to put in the time and effort, you can achieve your goals.

Until you’ve found your system, use the risk management of drawdowns on Apex to help you become consistent.

Confident Chloe

Chloe is too impatient to learn from her mistakes she thinks she has learned everything she needs to know about day trading after reading a few books or taking a few online courses. She starts trading with real money, but is not prepared for the volatility of the market. She makes a few bad trades and loses her confidence. Confident Chloe’s often give up day trading, thinking that they're just not cut out for it.

The Psychology of Trading by Van Tharp: This book is for the Confident Chloe’s who need to learn how to manage their risk and avoid emotional trading.

"The problem with most traders is that they think they know more than they actually do." - Van Tharp, The Psychology of Trading

Van Tharp highlights the importance of humility in day trading. There is always more to learn, and no one is perfect. It's important to be realistic about your trading skills, and to be willing to admit when you need help.

If you’re a Confident Chloe then I’ve got a few tips below for you:

Understand your risk tolerance. How much money are you willing to lose on a single trade? It's important to set realistic expectations and manage your risk accordingly.

Don't overtrade. It's tempting to trade more often when you're losing money, but this is a recipe for disaster. Instead, focus on making high-quality trades and taking profits when you can.

Be patient. It takes time to become a successful day trader. Don't get discouraged if you don't see results immediately. Just keep learning and practicing, and eventually you will achieve your goals.

Use the 50k Apex account to teach yourself patience, you have no choice but to build it up slowly and make small gains. Force yourself to celebrate the small wins.

Determined Daniel

Determined Daniel is disciplined and focused. He is the one who keeps going, even when things are tough. He’s not afraid to make mistakes and learn from them. He’s patient and persistent. He knows that day trading is a marathon, not a sprint. And eventually, through tears, gut wrenchingly hard days, self doubt and pain, Daniel does one day achieve his goals.

Trade Your Way to Financial Freedom by Van K. Tharp: This book is for the Determined Daniel who needs to learn how to stay motivated and disciplined in the face of adversity.

“The road to success is not easy, but it is simple." - Van Tharp, Trade Your Way to Financial Freedom

What I loved about this book is that Van Tharp emphasizes the importance of perseverance in day trading. It takes time and effort to be successful, and there will be setbacks along the way. But if you keep grinding away, you will eventually reach your goals.

We should all endeavour to become the Determined Daniels of the trading world. Here’s some tips on how to get there:

Have a trading plan. What are your trading goals? What strategies will you use? How much risk are you willing to take? Having a clear trading plan will help you stay focused and disciplined.

Take breaks. Day trading can be stressful, so it's important to take breaks throughout the day. Get up and move around, or take a few minutes to relax and clear your head.

Celebrate your successes. When you make a good trade, take a moment to celebrate your success. This will help you stay motivated and keep grinding away towards your goals.

Determined Daniel knows that winning small on Apex over 3 or more funded accounts is the holy grail. This is his mission.

Ultimately guys, I think all of us go through phases of being each of these people. I know I have. These personality traits are less of something that is fixed and more so something that evolves from one form to the other, often with blurred lines in between.

I could have had so many more personality types, Impulsive Ian, Tentative Terry, Degenerative Duncan. But you get the picture. Whether, you’re currently a James, Steve or Chloe, just know that Daniel needs to be your final form.

If you can put in the hours, the dedication and the patience, if you can take your losses as a learning curve and take you wins with humility, if you can learn to take small steps one trade at a time then Daniel will be who you will become, but you need to accept that it will take years to get there. One trade at a time!

Get 90% off your first month on Apex and 80% off monthly fees forever with code SAVE90!

Much love. PW

Apex Prop Trading

I found my consistency using Apex Prop Trading. I wrote about it in detail here.

Click here to find out more and get a 50% lifetime discount.

Walnut Footprints

I explain how to read my footprints here. You can download and use it for free.

I wrote a detailed breakdown of how to sign up for a 14 day free trial of Sierra here.