I can’t believe how many of you guys don’t know what the whole point of this prop game is. What are we trying to achieve by being prop traders? What is the end goal or the holy grail? (apart from getting rich).

What I also realised responding to each of you, is how much clarity some of you need around how prop firms work, how you should play them and importantly what account to choose. There are so many of you who have misunderstood the mission, that I thought I would dedicate this weekend’s educational episode to it.

The misconception is this: Sign up to an Apex account, pass the evaluation, get funded and start banking.

I am sorry to tell you but this is not the mission! Confused? Read on…

Firstly, remember to use SAVE90 to get 90% off your first month and 80% off your lifetime subscription to Apex. It is not being advertised on their site!

To explain the actual goal, I need to explain how a prop works in terms of drawdown and risk.

Its A Hard Prop Life, For Some

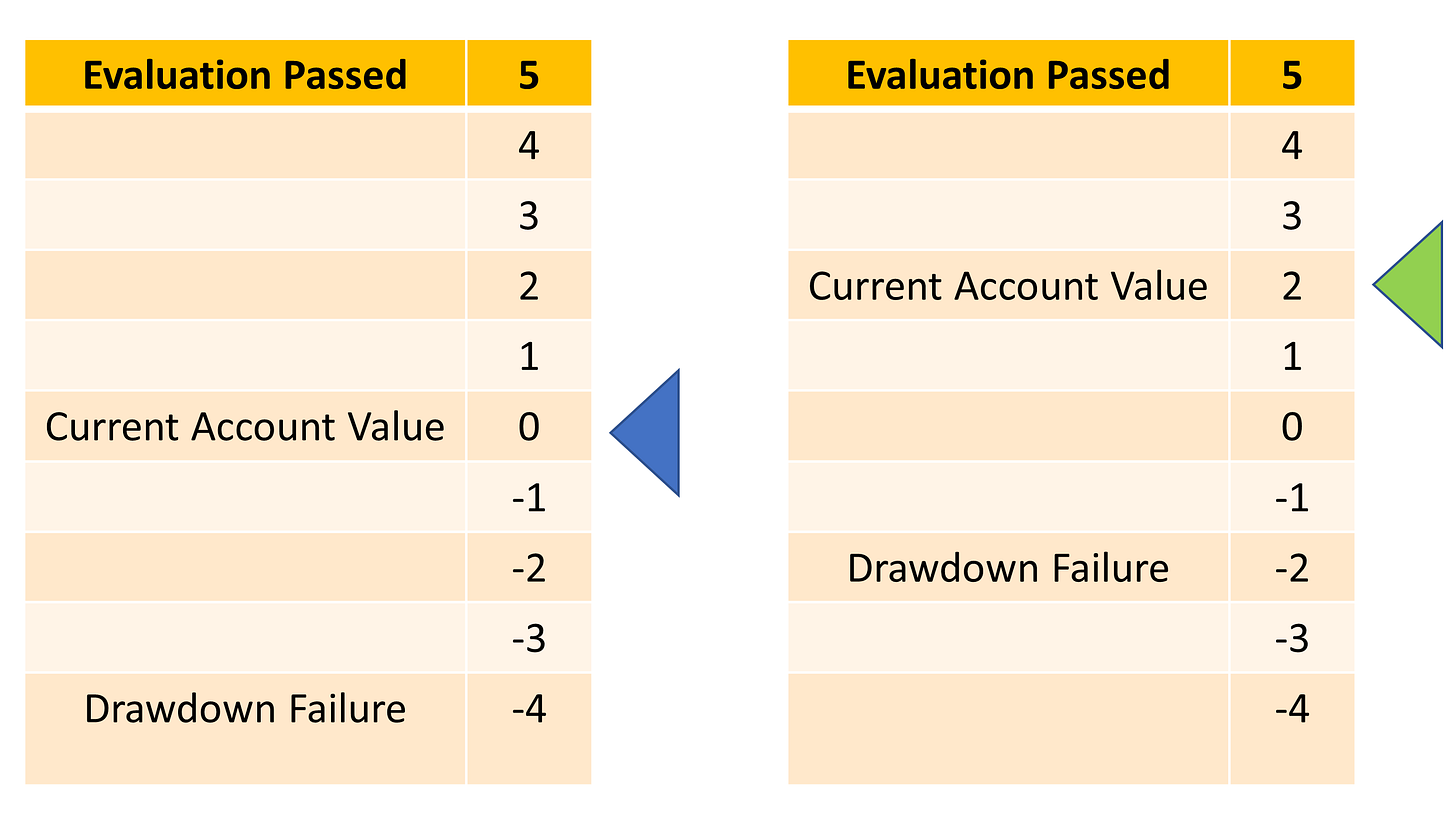

Let’s think of it like a ladder and lets say we have an apex account that starts at $0 and our aim is to get to $5 to pass the evaluation. Our position size means we are aiming for a $2 profit/loss with each trade. It would look something like this:

You can see our account fails when we lose $4 dollars and passes when we gain $5.

Okay, so now consider this scenario: You take a trade and you make $2 so our account value goes up, but so does our drawdown so now it looks like this:

Before the trade is on the left and after the trade is on the right.

You can see the point of failure for our account is now $2. The drawdown has trailed our account value but we are also closer to passing!

So now imagine we take another trade and this time we lose $2. The account now looks like this:

We are now only $2 away from our drawdown - closer to failure. One trade away actually as we were trading $2 a time!

Let’s consider this questions then: Should we have been trading this position size?

We now need three trades to pass our account, but one trade to fail it!

If we had traded 25 cents or even 50 cents, we would have gone up slower towards our goal, but we also would have come down slower towards towards our drawdown. Thereby allowing us to trade more and manage our risk more! Sounds sensible to me!

Look how the ladder changes if we trade smaller position sizes, here’s an example of trading in 50 cents:

Suddenly there are so many rungs on our ladder, it’s no longer do or die, we can have losing trades and try again and our aim now becomes to trade consistently to pass, not just take 2 or 3 trades and pass the account.

Sudden success leads to sudden failure. Avoid the “go hard or go home” mentality.

Get the right Apex account for your position size:

50k Apex Account → 5 MES maximum position size

100k Apex Account → 2 ES maximum position size

I am sure you can work out the rest from there.

The The Holy Grail

Okay, so let’s go back to the whole point of me writing this article, let’s break down what we are trying to do with these prop accounts. Here is the shocking news:

The aim is NOT to have one account, pass it and trade from it.

Instead, once you have passed your evaluation account - PARK IT UP and start another one!

Pauli, What kind of madness is this? Why?!

Well, the answer again lies in the risk! Let me explain:

Let’s take the 100k Apex account as an example. Say we are trading 2ES on it, and each tick gives us $25 so with two contracts we get $50 a tick, or in other words we move up and down our account ladder $50 a time.

Now imagine this, you have TWO funded 100k accounts that you have passed. And using the Sierra Trade Copier you make the same trade on both accounts at the same time. So when you hit buy, both your 100k accounts buy 2ES (so you have 4ES) and when you sell both your accounts sell 2ES (so you sell 4ES)

Now, imagine instead of trading 2ES in one 100k account, you trade 1ES in each one. You still make $50 a tick right? Because you own both accounts but what is the risk i each account for a tick now that you only trade 1ES in each?

That’s right, the risk is halved to $25, the chances of you blowing up have been halved because you have added more rungs to your ladder!

We are trading smaller sizes, but making the same gains via multiple Apex prop accounts using the Trade Copier.

Now we can keep going, what if you have 4 passed prop accounts? 8? Apex allow you to have 20 multiple accounts in the same household!

So my friends, the holy grail is not to pass ONE account, realistically, I would say you aim for FOUR funded accounts. In doing so you will become a consistent and precise trader because you got there with small and gradual returns.

If these were 100k accounts, you could trade 1ES in each one and risk $25 a tick in each account but if you make a profit then you’re banking $100 a tick. I hope that makes sense, it isn’t easy to explain!

So if you are going to play this prop life and be successful, you won’t make it passing one account.

Become consistent in your trading by making small wins that take you to the pass level in one account

Pass your account and park it (yes, this means your monthly fees are a sunk cost)

Once you have 3+ accounts, use Sierra Trade Copier to trade from all three at the same time and continue trying to pass more!

These steps will make it highly unlikely that you blow up your funded accounts, they minimise your exposure to the volatility whilst giving you the full gains as if you were trading from one account!

It’s a no brainer, it is the holy grail!

Let’s work towards it, together!

PW

Apex Prop Trading

I found my consistency using Apex Prop Trading. I wrote about it in detail here.

Click here to find out more and get a 80% lifetime discount.

Walnut Footprints

I explain how to read my footprints here. You can download and use it for free.

I wrote a detailed breakdown of how to sign up for a 14 day free trial of Sierra here.

Great well thought out article. Would expect no less from you my friend

Saved!