Footprints & Order Flow: Chapter 2

Special Episode: Pauli Probes The Market

Those of you that have followed me for some time know that I use three essential things to give me my bias for a trade. They are:

1. Price action (Chapter 1 of this series is here)

2. Footprints (Chapter 1 of this series is here)

3. Order flow

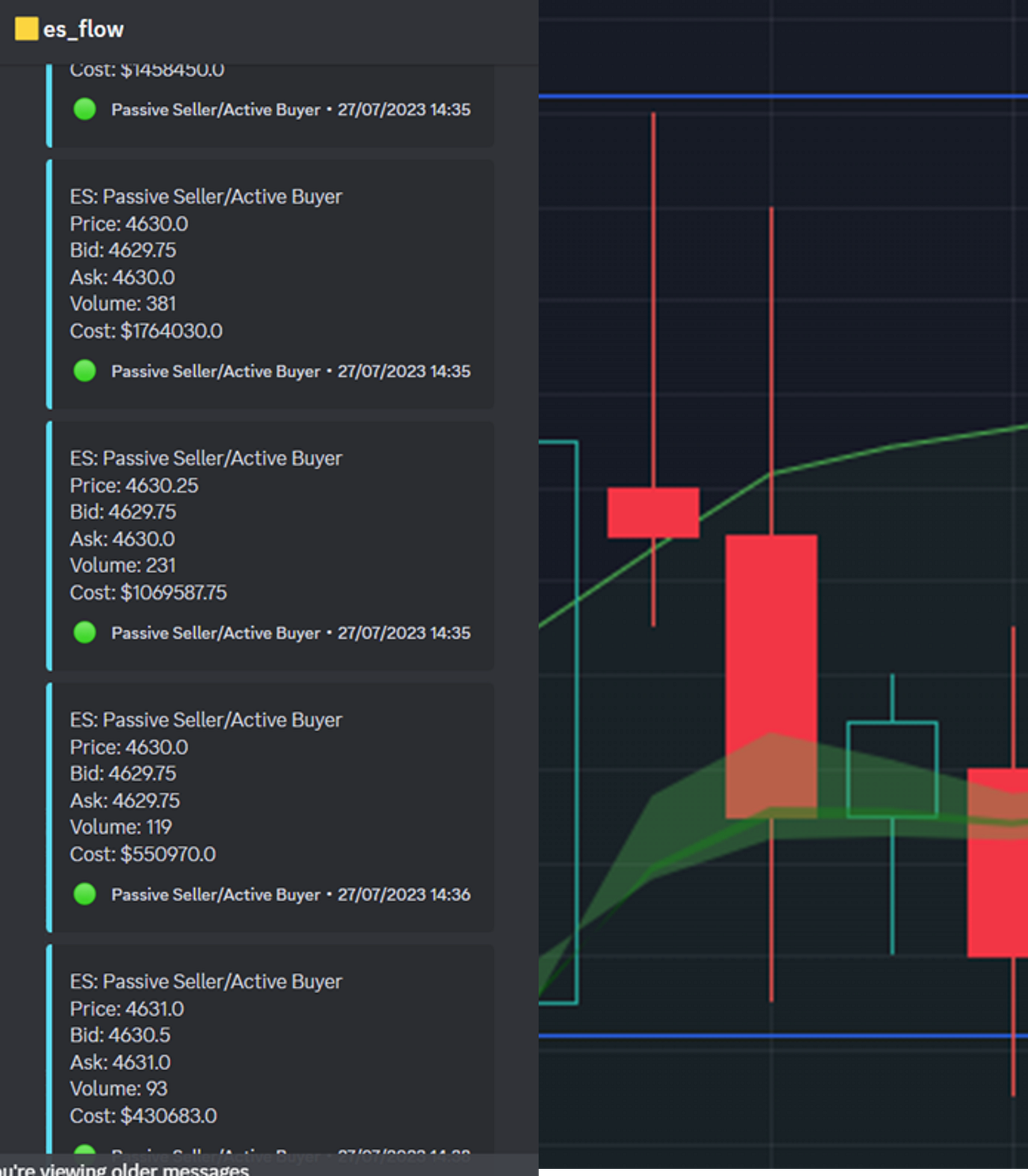

I have spent a lot of time breaking down the first two in my special episodes, so today we are going to have a deep dive into the third. This post has been inspired by how useful people are finding my real-time flow bot in the discord channel that has been throwing out alerts like this:

There are two main types of order flow data: executed orders and advertised orders. Executed orders are those that have already been filled (like the one above), while advertised orders are those that are still waiting to be filled (which show up on the market depth side of the DOM).

There are lots of elements I could talk about within these two types, but the focus of today’s episode will be:

· What is a passive and active order execution? How can we use them?

· How can we identify intraday support and resistance via advertised orders?

· What order flow patterns should we be looking for when reading the tape?

Passive & Active Order Execution

Active order execution is when buyers or sellers execute at the market price with no waiting around. Passive order execution is the most common type of order execution for day traders. When you place a passive order, you are essentially saying that you are willing to wait until the market reaches your desired price before your order is filled. These are often executed via limit orders and give the buyer/seller the best price for their execution, important things to not here is:

· When a passive buyer hits the tape, this appears as a “sell side order” as the buyer has been filled at the bid (the lower price) for their long entry

· When an active buyer his the tape, this appears as a “buy side order” as the buyer has been filled at the ask (the higher price) for their long entry

Similarly, for those going short:

· When a passive seller hits the tape, this appears as a “buy side order” as they are being filled on the ask (the higher price) for their short entry

· When an active seller hits the tape, this appears as a “sell side order” as they are being filled on the bid side (the lower price) for their short entry

So you can see in the image above, that someone executed on 200 contracts at a cost of $917,050. And they hit the ask side of the order, so this is either an aggressive buyer or a patient short and working this out is the million-dollar task so let’s try:

Let’s have a look at the heavy sell off that happened on 7/27/23. We opened up having gapped up by nearly a whole percent on ES. At the opening bell this is what the Walnut Footprint picked up:

You can see from the above that in the first 5 minutes of RTH we saw a passive-seller/active-buy execute 1049 contracts, wow! Then another execution for 231 contracts – bot on the ask side. In these situations, I ask myself three questions:

1. Where price is now, could this be the top of the current move? If so, then this is likely distribution.

2. Where price is now, could this be the bottom of the current move? If so, this could be accumulation.

3. Has there been an aggressive move up or down within this candle? If so, then this is urgent action by someone in a position.

The only valid question for these prints on the tape is question 1. This is likely distribution, of course we might be wrong when we make these assumptions, but if I am in a position here and those numbers hit the tape at the possible top/bottom of a move – I am done. Look what happened after that last candle:

A huge sell off. But what about those large sell side prints above vwap? Go back to my three questions. Which on do you think these are? Comments below welcome!

Advertised Orders & Market Depth of DOM

This one I hope is easier to digest than the above. Advertised orders are orders that have not yet been filled, but are visible to other traders. They can be a valuable tool for day traders who are looking to identify support and resistance levels.

Advertised orders can help day traders to identify support and resistance levels by showing them where other traders are placing their orders. If there are a lot of buy orders at a particular price level, that price level is likely to act as support. If there are a lot of sell orders at a particular price level, that price level is likely to act as resistance.

Here is a great example shared by the ever-present Lewis De Payne:

You can see a huge anomaly on the advertised orders down below. There is a simple rule to follow when looking at advertised orders on the DOM:

· Price travels from one pocket of liquidity to another.

· If the market is to go higher, buyers will take their fills in lower liquidity pockets first

· If the market is to go lower, sellers will take their fills in higher liquidity pockets first

Knowing where these pockets are will enable you to see why price might be moving in a certain direction. Are we going lower to get our fills? In the chart above, if price did go down to 4350 to collect that advertised anomaly, do buyers show up and price recover? If so then you might be able to use that to your advantage.

Another great feature of seeing advertised orders is being able to see how these are changing in real time. This is called “pulling and stacking”. Sierra charts has a feature where you are able to see orders being added and removed in real time – as a result of this, you can see if buyers or sellers are queueing up to get in involved in the price action. Having this on your DOM is a must.

Right, here comes the caveat with advertised orders, if I wanted to manipulate the market, once of the easiest ways to do this is to create a “false order” on the DOM. I could advertised that I am a buyer of 500 contracts on the DOM, and as price begins to fall towards my order, I could simply pull the order, doing this will not only trap buyers but also create a domino effect for sellers. Beware of false flags being advertised, often these are huge price anomalies, and often they are a trap!

Pattern Identification Via Order Flow

Okay, let’s move onto the final part of today’s episode. Now that you have a basic understanding of reading the tape and you can read the basics of the DOM what kind of patterns are we looking for. The answer is a very basic one:

The goal of order flow is for you to identify who is becoming trapped in the market.

Did sellers try to push price down and fail because buyers kept stepping in? Did buyers try to take the market higher but failed as their buying was absorbed?

How do you answer this question? Let’s look at my flow bot for the answers, here you can see a series of alerts from the morning of the 27th that we looked at above already before the big sell off:

We can see huge buying taking place (please ignore the time stamps, this is UK time!). Now lets look at the price action on the candles when these prints were coming through. How can we have such huge buy side action happening and yet we see bearish price action? The answer should be clear now, either these buyers are being absorbed by sellers or these large green prints are actually a passive seller on the tape!

And it is this pattern recognition that you must master in order to gain an understanding of what price might do next.

· Are you paying attention to the large prints coming through?

· Are you looking at price action to see if these are active or passive moves?

· Can you begin to see who might be stuck? Buyers or sellers?

· Can you find pockets on the DOM that sellers will want? That buyers will want?

· Does price action support your thesis?

These are the questions you need to find answers to and in an active market, this will take you hundreds of hours of practise to even begin to be confident.

Don’t risk your own money whilst learning to trade, use the Apex 80% sale instead! Sale finishes this week!

Until next time. Much love.

PW

Apex Prop Trading

Don’t risk your own money until you are a consistent trader. Use Apex instead. I found my consistency using them. I wrote about it in detail here.

Click here to find out more and get a 80% lifetime discount with code SAVE80

Walnut Footprints & Sierra

I explain how to read my footprint chart here. You can download and use it for free!

I wrote a detailed breakdown of how to sign up for a 14 day free trial of Sierra here.

Walnut Discord

I want to grow our discord communities (clubs) so that they are self sufficient and a place of safety for newcomers. To do this we operate under a slow-growth policy, to be added to the waiting list click here.

Another banger from you Pauli - infinite thanks for sharing your wisdom & helping us newbs unravel the nuances of trading.

😵💫 I just downloaded sc, your chart books last night! Get outta my head! 🤣 great write up, great timing as always