Once again I had to have one of those conversations. I have lost another friend to the F.I.R.E. Another participant burnt to a crisp by the forces that drive the markets. Jayden has allowed me and helped to write this article for you. So that we might all learn some lessons from his journey and that some good might come out of his story.

Just like the army of some third world regime that brings in conscripts to churn out in battle. The market has its own conscription fodder that it churns out on a 1 to 3 year cycle. Who are the fodder? Well, over the years I have built up a profile of these people. From what I have seen, the market preys on the following types of people:

· Hard working people who know how to put in effort

· They have around $5k to $20k in savings

· Often they are middle-aged men with children

· At times, they are 18 to 24 year olds with a middle-class background

· Broadly, they are well educated or well skilled in a profession.

These groups of people all have one thing in common. They often see through the lies of their governments and the corporations that they serve. They understand their role as worker slaves to this ruling elite and they understand that the financial system is made to hold them in debt until they die. With this mentality, they see a life of F.I.R.E (Financial Independence & Retiring Early) as their only hope of escaping the mundane path that they are on.

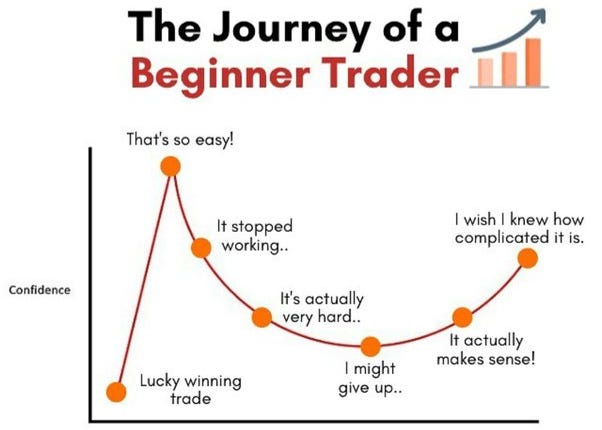

Once these people discover the market, things change, often for the worse but sometimes for the better.

Jayden was just the same as these people and when he first started out, his first six months made him more money than he could make in a year. Then, gradually, over the course of the next four years, he lost it all – and then some.

Jayden and I spoke for some time about his journey, thankfully his wife is willing to forgive him and the damage he has caused to the day job is saveable. He can get his life back on track, but he agreed that from our discussion and from his story there are the FIVE rules he wished he had followed and wanted to share with you all. We called them “The Five Rules of FIRE”.

Rule 1 – Don’t invest your own money until you are consistent for a whole year.

This sounds easy, but he never used a prop account until it was too late. His habits were bad and his methodology broken. Prop accounts not only allow you to save your own money but they also teach you how to manage your risk by using drawdowns. Jayden was so used to trading without a seat belt, that the crashes he had been through had left him too broken to begin to learn a new skill.

How do we put this rule into practice?

If you are in your first four years of trading, don’t use your own money. This is why I use Apex and this is why I wrote my special episode on why you should too.

Rule 2 – Don’t oversize your position.

When Jayden made his first three trades, he didn’t realise what he was setting into motion, he put $10,000 into a single stock (50% of his portfolio). (Un)Luckily for him it was a great play – he turned it into $13,000 in two days. From this point, he spent the next two years with position sizes of a similar size. In the end, his luck ran out, the market changed and after that, each trade he made from his $147,000 portfolio, week after week, was a loser. Until there was left with nothing.

How do we put this rule into practice?

In Apex, I have a very clear rule about position sizing that I follow religiously. It goes like this:

On my $25k account -> never hold a position larger than 4 Micro ES.

On my $50k account -> never hold a position larger than 9 Micro ES.

On my $100k account -> never hold a position larger than 18 Micro ES.

I always scale in and scale out of my positions. Using this rule I can ensure I am never overexposed to the market and it’s bullshit.

You can get an 80% lifetime Apex discount this weekend, use the code WALNUTS and sign up here.

Rule 3 – Cut your losers, never get high on Hopium.

Jayden thinks back to one trade that really broke his back; it was a merger play. The company that would have been created by the merger would have been worth $15+ a share. Currently it was trading at $5. At the earnings call for the merger, the news came in of a delay in the deal. A five-month delay, and the price plummeted.

Jayden didn’t have a stop and seeing how far in the red he was within 5 minutes, he decided he would just keep adding to his position, knowing that the merger was coming in five months. You can guess what happened next right? The merger was cancelled a few months later and the stock went to sub $1. Jayden held, his $60,000 until he couldn’t bare it any longer his position had turned into being worth $3,000 and he took it out last month and admitted defeat.

How do we put this rule into practice?

There are two steps for this rule.

STEP 1: Entry in a position is king. Always remember that, write it on a post-it and stick it to your computer. You want your entry to be close to the place where the move would begin to fail as possible. If you can master your entry, then the next step is easier:

STEP 2: Use hard stops. My stops are 8 ticks down from my entry. If your entry is no good, you will get stopped out and die a death by a thousand cuts over the trading day. Your entry has to be solid for your stops to actually work.

Once the move starts going in your direction, scale out a couple of contracts, and move your stop to break even. Never let a winner turn into a loser. Ever.

Rule 4 – Take profits as you go. Don’t scale up for the first two years.

At one point during his trading journey, Jayden was able to pay off his car loan, pay off all his credit cards, book a family holiday, make extra mortgage payments. He did none of that. Why? Because he wanted to hit the jackpot. He wanted half a million dollars before pulling anything out, and he thought taking money out before then was a bad financial decision. Big mistake and one of his biggest regrets.

How do we put this rule into practice?

I don’t like to build up my portfolio size in Apex too much. There are two windows every month where you can withdraw money and I always do. I leave enough money in the account to give me a buffer with the drawdown (it stops trailing once you have the same amount of profits as the value of the drawdown itself) but beyond that, I take my gains. Sizing up does not work for me, maybe one day I will try again but for now, I take my money and run.

You can get an 80% lifetime Apex discount this weekend, use the code WALNUTS and sign up here.

Rule 5 – Don’t keep it a secret from the ones you love.

Jayden’s lucky, he punched above is weight to get his wife. When he started trading, he told her of the gains he was making, she was understandably elated. But his mistake was not sharing his bad days with her, not talking through the good and bad decisions he was making. Had he done this, he might have hit the brakes sooner, if he had thought about the damage he was doing to his family, he might have used stops, he might have taken profits, he might have made better decisions. In the end, he kept it a secret from everyone until the very end.

How do we put this rule into practice?

You already know who the good people are in your life, choose the person you tell wisely, they will need to be your emotional support, your companion on the journey but they also need to be the person to put you in your place when you need it!

In the end guys, a trader’s journey is never simple. Some people only play the market for a side hustle, others play it in the hope of going full time. And others don’t play it all, they get played and never see it coming until it is too late.

Don’t be the next Jayden. Work hard. Study. Find your method. Find your consistency. And until then, please manage your risk, use a prop account and not your own hard-earned cash! You can get an 80% lifetime Apex discount this weekend, use the code WALNUTS and sign up here.

Sincerely,

PW

This hit hard. I've been trading since 2019, am basically a jared, got smoked hard last 3 years trying different things. Found you after I had made the switch to trading MES and already use APEX to avoid using my own money. What you stated in this article is pure truth and fact, if we want to avoid getting destroyed in this market we need to follow everyone of these rules. Good read!