I don’t always want to be cheerleading about how well my methods and my levels work. Yesterday, I had a bad day at the desk. I am by no means the greatest trader, is there even such a thing? I have good days and bad days but more than anything I know how to manage my risk so that any loss is not the end of my trading career.

But after yesterday I was annoyed at myself. I spent some time thinking and reviewing and for me the main mistakes I made were:

I over traded in areas where I thought I saw price about to pivot but I did not wait for confirmation

I position sized wrong for the type of day we were having

I didn’t consider the impact of Opex going into Friday

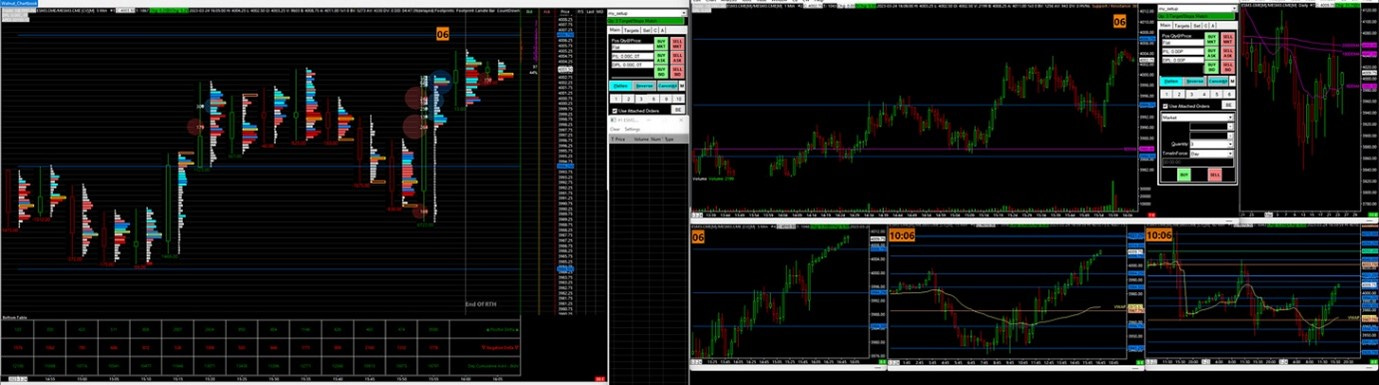

But beyond all of these points, I think one of my biggest mistakes was becoming distracted by my new setup. As regular readers will know I have been using a new type of chart to help me really zoom into price action and the intentions of buyers and sellers. So my charting recently has gone from this:

To suddenly having much more data and information, such as this:

In making this change very rapidly, what I have ended up doing is forgetting my bread and butter, the basics that keep me green. I stopped taking entries on confirmations of walnut levels and started to trade in the no man land in between my levels. In doing this, I myself became victim to my own absent mindedness.

If you are also finding yourself having a bad day, then my advice is this:

Take a break.

The first thing you should do after a bad day of trading is to take a break. Get away from the charts and the news for a while so that you can clear your head.

Analyse your trades.

Once you've had some time to cool off, take a look at your trades and see what went wrong. Were you making emotional decisions? Were you trading against your trading plan? Once you understand what went wrong, you can start to develop a plan to avoid making the same mistakes in the future.

Remind yourself of your goals.

It's easy to get discouraged after a bad day of trading, but it's important to remember why you're doing this in the first place. What are your financial goals? What are you hoping to achieve by day trading? Keeping your goals in mind will help you stay motivated and focused.

Don't overtrade.

It's tempting to try to make back your losses as quickly as possible, but this is usually a recipe for disaster. Overtrading can lead to even more losses and can damage your trading psychology. Instead, take a step back and focus on developing a sound trading plan that you can stick to.

But most importantly:

Do the basics right.

Never forget about resistance and support, higher highs, lower lows. The 9ema for direction confirmations. The walnut levels. All these things that are the most simple are often the most powerful!

I went back last night and had a reach through chapters one, two and three of the my own trading methods. I needed a reminder of what it is that has got me here, and of course I need to continue to build my method, but it will only be successful if do the basics right!

So today, I intend to do the following to get me off tilt and back to some sense of normality. I will

Not be trading until an hour after RTH so that the initial balance has been defined

Reduce my position sizing by half to take some of the risk off the table

Walk away for the day if I make more than two losing trades back to back

Only take setups that are A+ in my playbook

Take the best entries and not chase anything that I miss

Only use the 3min and 5 min charts for entries and exits based on the walnut levels

I know it sounds basic, but if you go and look at the days where it all went sideways for you, I am sure you will also find that you overcomplicated the moves unnecessarily.

Today is Opex Friday, let’s do the basics right.

PW